ITR or income tax return is one of those things where no matter how many times you did before still there is always something which will go wrong. There are several reasons such as many people don’t know what are the options they have in filing the ITR or what documents do they are going to need. Well, the basic reason behind that is the long process and the paper works which confuses the new taxpayers as well as the old ones too. For making the whole thing simple as less hassle-filled, there is an official website where you can simply log in and do the work online. For understanding the whole things much better, here is the complete information that will help you so you can file the return much easier. Check Income Tax Login & Registration- A step-by-step guide below.

Income Tax Login and e-Filing ITR Account Registration in India

It’s important for taxpayers to have themselves registered to the income tax department website. Having your own registered user id will help you in accessing the information easily and without facing any hassles. Also, you can check information related to the tax return that you got previous years, check the refund status and also do verifying your income tax returns.

What you are going to need?

Well for registering yourself in the portal of income tax, there are few things that you must have with yourself. Also, there is a law that people who are confirmed minor, idiot or lunatic and banned persons are not capable of registration as per the Indian contract act that was passed in 1872.

If you are not any of them, then here is the list of things that you must have:

- Valid PAN number

- The email address that is completely valid and registers on your name

- Your current valid address

- Also, your mobile number which is valid and in use is also going to require.

Here are the Steps that you should follow for Registration:

There are no difficult things that you will face, however for making it simpler you can just follow the given steps

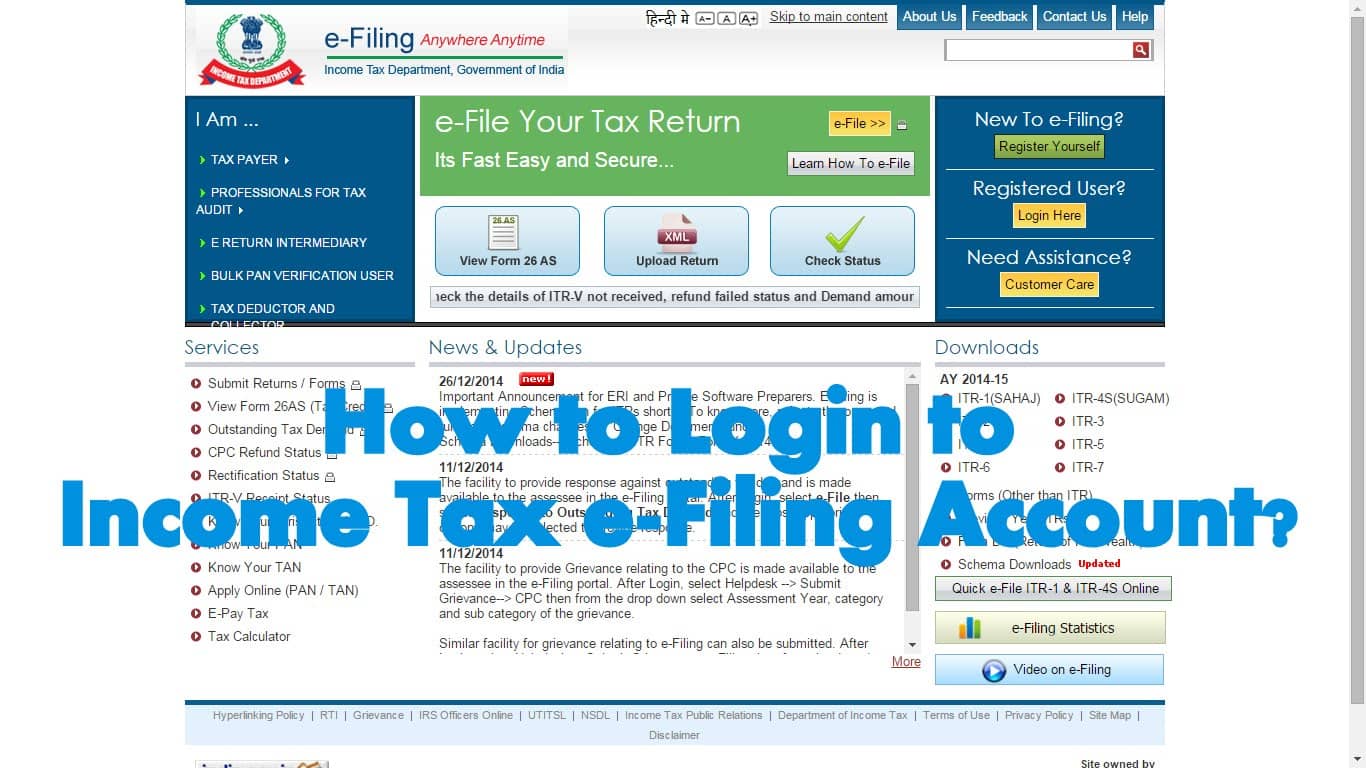

Step 1: Visit the official portal of the income tax department. There you will get an option on right side of the page where you have to click the option register yourself.

Step 2: after that, you have to choose the type of user. Here you will get different options where you have to choose any one option

Step 3: Fill the information that has been asked, it mostly includes your PAN number, Surname, your middle name, the first name, your DOB, and the residential status.

Step 4: after you fill that form you will get another form where you have to fill mandatory information. The details are going to be a related password, your contact, and the correct answers of yours. After you fill the details before the submit.

Step 5: another step is to verify. For that, you received the OTP with six digits that will send to the number and also the email that you provided earlier. However, the OTP is only available for the 24 house, in case you fail to verify then the whole form will be filling one more time.

How to Reset Forgot Income Tax Login Password- Guide:

It’s really obvious that people forget passwords; however, there are simple steps that can help you in resetting the password for income tax login. Here is how you can do that:-

Step 1: Visit the portal income tax department

Step 2: You will get a login here the option to the home page that you have to click

Step 3: after clicking the Login and the entry page. After that, you will get forget password where you have to fill the user id and captcha code.

Step 4: the page will redirect you to another box where you have the basic information to fill. The list follows the answer secret question, also have to the upload DSC, the OTP and final thing that you have to add is the Aadhaar OTP.

Discuss 3 Ways to File your Income Tax Returns:

Filing an income tax return is maybe hard for some people. Especially for those who are going for the first time. There are ways that can help; well basically you get three options which can make the filing the income tax returned much easy.

1. Tax Preparers

Well, the complex federal tax is not less than 74000 pages which are long. However, for that, there are lots of people choose to hire someone for the help. Well, if you are going for this way then you should have the PTIN which also stand for Preparer Tax Identification Number. Not just that, If the files are more than 10 regarding the return then you are going to need that returns should be electronically filed as this is what the IRS requires.

2. E- File

For those who don’t want to take a load of thousands of pages, they should choose the e file option. There are many other benefits that you are going to get with this option. Also, it’s much faster and easier options. You can do the filing with the app using which will also automatically find the errors.

3. Paper Returns

This option is known as a traditional way of filing the paper returns. However, it will take around six or eight weeks that you will get the returns. You can do the submission via the mail especially if you relate to these given options. However, there are a few things that you need to understand

- If you are living in the property state community and now you are married but doing the separation filing return

- If you are claiming something dependent which is also pre claimed by some other person

- Submitting the form for tax which is not able to fill via e- file option which mostly includes multiple support agreement

- Before the e file window or after that, you are going to file the return.

What is Form 26 AS:

Well, Form 26 AS is a statement of annual consolidated tax that can easily be accessed directly from the site of income tax. However, every payer who pays their taxes can use their Pan which is also known as Permanent Account Number. The amount that you have to pay for the taxes has been deducted if you already paid it. Also, the details regarding this deduction will be saved in the database of the income tax already. For knowing the details you can refer the form 26 AS where you could find the information, not just that you can also know if your tax is paid by the secondary party which can be the bank or employer. Along with that, form 26 AS has the details regarding the deductors name and their TAN, also known as Tax Deduction Account Number.

What is the importance of Form 26AS?

The basic reason why Form 26 is so important is that basically, it’s a financial document where you get all vital statements regarding your tax. Such documents can help a lot and also can consider as important documents. Apart from that, here are a few reasons because of that the form holds such an importance.

- The form is helpful when it comes to knowing if the deductors filed the accurate statement of TDS. If someone paid on your behalf, you can get the information about the details as well, however, for that, you are going to need TCS.

- With the help of this, you are also able to check if the tax is deducted on time or not. Also, you can get the information if the deductors or collector deposited the tax deduction on their respective date and time to the government. It’s a good option to keep you with the updates and all information regarding when the tax deduction happened and from whom.

- Form 26 AS is also work as verification when it’s about tax credits. You can use it for the computation of your income when you are going to fill the form for income tax return. It plays an important legal paper which can help a lot.

What are the benefits for Filling income Tax Online:

To start with this way of filing, it’s important to understand why you need to prefer e filing above other options. However for knowing it better, here are the top benefits that you can get if you choose the filing income tax online

- It’s easy:

Vast of majority find online filing much simpler and easy as compare to going with other options. Also, other options involve too much work, long process, time-consuming meetings and lots of tiring work that waste a huge amount of time. If you are going for the traditional option then there is some hassle-filled process whereas the paperwork option needs lots of attention so you can go through each and every page. However, you can just hire the professional for that but it will add extra expense to your list which is not something that people really look for. Not just e-filing reduce all such works but also it makes the work much hassle-free and convenient for the users.

- Get the easy tracking status:

Well in past the users have to wait lot so they can check the updates. Not just, it took more than just time but also the whole thing gets more drag then it should be. But with an online option, they can check the status whenever they want without waiting for anything or for anyone. Also, it’s easier to access the information as for that you just need to have some basic details related you so you can log in to the portal.

- Simple access to the documents:

Well for those who require documents often for them it’s a good option. For online option, you have to update the documents which create a database of yours. The database let you access the documents whenever you like and without facing any hassle. It not just save your important documents to one place but also keep the information safe

Required Documents to Filling an Income tax Form?

There is no doubt that documentation is very important which because of which lost of people face hassle as they don’t know what they are going to need. Well, recently Aadhaar card is added as one of the most crucial and mandatory documents that the taxpayer shave to provide along with other important documents. Not just that, those who don’t have the Aadhaar card yet they can use the enrolment number for processing the filing for ITR. Apart from that, there are lots of things that are important to know, make sure you have a complete idea so you don’t have to go through with all process one more time.

There are a few most important documents that you are going to need before you file the income tax form. Here is the list that will help:

- PAN card

- If you are a salaried employee then you are going to need Form 16 from the employers of yours

- Form 16 A from the bank

- Form 26 AS

- Your bank statements

- Details related the properties

- Certificate of home loan

- Proofs related the investments

- Aadhaar Card

- Salary Slips

- Business or profession details regarding the incomes

Conclusion:

Income Tax return is not just important but it’s also hectic for those who are going to face it for the first time. However, knowing the basic information like how you can file the ITR online or any other ways can help in getting the best options. However E filing considers as easiest and high recommend by people who are filing the tax return for a long time. Apart from that, understand the documents and other different steps so you don’t face any hassle and the process will go smooth.