Pervasive instability had encountered with the implementation and application of the Goods and Services Tax (GST) in 2017 ever since individuals and businesses that provide goods or services have also been needed to initiate the GST registration process.

What is the Goods and Services Tax?

Goods and Services Tax (GST) is a cost-added tax imposed on most national-consumption products and services offered. Customers charge the GST; however, the companies that sell these goods and services mandate this to the nation. GST provides the government with income. The goods and services tax (GST) is a tax on products and services offered for sale domestically. The levy is also included in the total price and charged at the time of purchase by buyers, it is transferred by the retailer to the state. The GST is a specific tax used by most countries worldwide. It is typically charged nationally as a set rate. From the moment this was implemented in 2017, the goods and services tax (GST) had become contentious. Although there is a lot of controversy surrounding this notion, the swirling tax effect which was previously implemented is recognized to have disbanded.

How Does it Work?

Several GST countries have a single consistent GST structure that implies an individual tax rate that is imposed across the world. A government with a typical GST structure fuses federal taxes with taxation at the state level and raises them as a single tax.

Online Registration

GST registration can be performed through the GST Portal online without any trouble. One needs to fill in a form on just the GST Portal and upload the documentation required to be registered. If individual companies operate without GST approval, it is considered a criminal offence.

Documents required for registration at GSTgov.in:

- Aadhar Card

- Bank Account’s statement

- Permanent Account Number

- A cancelled cheque

- The digital signature of the individual

- Address proof of the business

- Address proof of the individual

- Photographs of the business entity

- Valid business registration

The Procedure of GST Registration Under GSTgov.in:

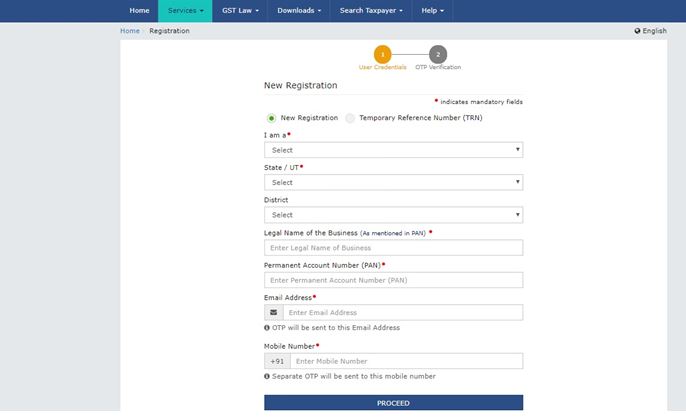

- Go to GSTGov.in and tap on ‘register now’ under the head of Taxpayers

- Tap ‘New Registration’ and in the drop-down panel below’ I am a ‘tap’ Taxpayer. ‘Then pick the state and region

- Enter your company name and PAN together with your mobile number and email address. On them, you will get OTPs. Next, press Proceed

- Enter the OTP received and continue

- After getting the Temporary Reference Number, note it down

- Tap on ‘Register Now’ on the GSTgov.in

- Enter the Temporary Reference Number and the continue

- Enter the next OTP received and continue

- You will receive the position of the draft, and you will be able to edit accordingly

- Next, fill in the necessary details like your photographs, address proof, the form of authorization, bank account details

- Go to the verification tab, tick the sentence and send your application

- You should receive a message stating that the verification has been completed. Your Reference Number of Request (ARN) would be sent to your mail address and phone number

Registration from GSTgov.in is hassle-free and convenient.

GST Returns:

GST return is a document comprising all the transactions, acquisitions, sales tax received and import taxes paid. Often recognized as export tax is a tax collected on sales as well as the tax levied on purchases is classified as import tax. It takes into consideration every other transaction which any person has ever rendered.

It is necessary to keep the due dates for GST returns in mind.

Types of GST returns:

- GSTR-1: GSTR-1 is the return to be given for recording reports of all external purchases of goods and services rendered, which in other words, selling payments made throughout a tax cycle, as well as for documenting the debit and credit notes released.

- GSTR-2A: GSTR-2A is a document which contains information of all incoming acquisitions of goods and services, i.e. transactions made throughout a tax span from licensed suppliers. The data were auto-populated in their GSTR-1 return based on data reported by the distributors.

- GSTR-2: GSTR-2 is the return for disclosing incoming goods and services resources, i.e. sales made throughout a tax era. The specifics in the return of the GSTR-2 are auto-populated from the GSTR-2A.

- GSTR-3: GSTR-3 is a monthly overview report for the furnishing of detailed descriptions of all outward supplies made, inward supplies obtained and input tax credit claimed, together with tax obligation information and tax payable.

- GSTR-3B: GSTR-3B is a monthly self-declaration to be sent to provide detailed descriptions of all external supplies made, input tax credit claimed, tax responsibility assessed and taxes paid.

- GSTR-4: GSTR-4 is the return to be submitted by taxpayers who qualified for the GST structure program. CMP-08 is the return that substituted the GSTR-4 formerly in operation.

- GSTR-5: GSTR-5 is the return to be lodged by international taxpayers who are listed under GST and are engaging in business activities in India. The return includes details of all external supplies created, obtained inward supplies, credit/debit notes, tax liability and taxes paid.

Due Dates for GST Returns

GSTR-1: The due dates for GST returns is 11th* of the next month with effect from October 2018.

GSTR-2: The due dates for GST returns for this type is 15th of the next month.

GSTR-3: 20th of the next month is considered as the due dates for GST returns for this type.

GSTR-3B: 20th of the next month is the due dates for GST returns here.

Filing a GST Return

Both taxpayers who may have enrolled below the GST, consisting of manufacturers, customers and entities who may have registered under the GST are entitled to express their GST returns.

- Go to GSTgov.in

- A 15-digit identification number will be generated, predicated on your PAN number

- Download the report listing all the transactions which will produce an invoice code number against every other submitted invoice

- Then post all incoming, outgoing and combined monthly returns online, you could always fix the discrepancies by returning the returns

- Submit the outbound supply returns in GSTR-1 format before the 10th of each month via the information section of the GST Standard Portal, keeping in mind the due dates for GST returns

- GSTR-2A provides all specifics of the company’s external sales to the receiver

- The person who receives will have to check, verify, and modify outward supply details as well as file credit or debit note specifics as well

- The receiver must provide in-house suppliers of taxable products and services in the GSTR-2 type

- The supplier does have the choice of either accepting or rejecting modifications by the addressee in GSTR-1A to the specifics of the inward materials.