A tax reform like GST is bound to turn heads and have ample opposition. In a country like India, economic bills almost always boil down to political agendas and the GST was no different.

Before the GST was actually implemented, several GST bills had failed in the Parliament due to the lack of proper backing by states. Even the current bill and tax cuts see the same fate.

Of course, a lot of times, the reason for state’s refusal on a bill is because of a political agenda, but they might, at times, also have legitimate reasons for disapproval, for example, some states refused to back GST because of the complications it was bound to create, from new rates to a GST invoice, the bill was ready to create havoc. Let’s look into why some states opposed GST at different stages of the bill.

5 Reasons Why Some States Opposed the GST

- Change of taxation route: Before the GST was implemented, tax on goods was collected by the manufacturing state, however after the implementation of GST, the whole amount of the tax collected goes to the state in which the product is sold or bought. To explain this better, for example, we can say that even though a product is manufactured in Maharashtra, the tax on the product because it is sold in Kerala, is to be collected by the state of Kerala. None of the tax revenue is to be collected by Maharashtra.

This was seen as a detrimental move for states that were mainly manufacturing goods and not selling them directly. This was one of the reasons as to why manufacturer states opposed the GST.

- Economic reasons: Due to the fact that the Central Government was willing to compensate the states with only tax revenues of five years, a few states refused to join the choir that preached for GST.

This move of the government puts states at a severe disadvantage where they have to face a financial blow, especially if these states manufacture goods and not simply sell them. The Center only compensating for five years sounded like little compensation, and therefore a few states opposed the implementation of GST

- Political reason: In the context of India, economics can never exist outside of politics. One of the major reasons as to why the GST was opposed at several stages was because of political loyalties.

The GST has been opposed by several parties at several different stages. During the UPA government, Gujrat vehemently opposed the GST for the reason allegedly being that the state would end up losing crores, however, no proof to support the statement was provided.

Recently, before it was implemented, the UPA led states opposed the implementation of GST and to this day, different forms and types of tax cuts and rates are opposed by the opposition for no legitimate reason and claims that have no proof to back them.

- Social reason: When the GST was implemented, the country was still reeling back from the disastrous implementation of demonetisation. A few states backed out from giving GST a thumbs up because the people of the nation were still recovering from a huge economic set back that shook the entire nation.

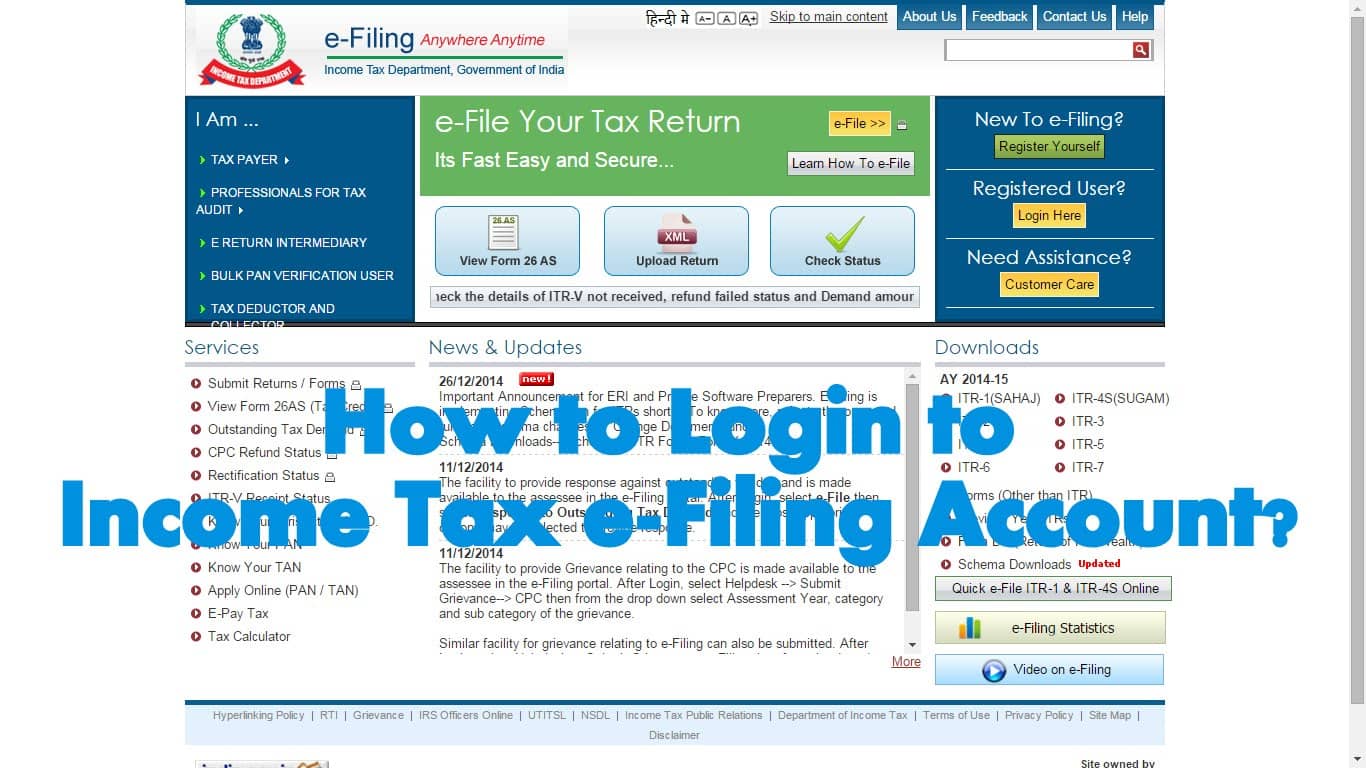

The implementation of GST, while it wasn’t as sudden as demonetisation, was still quite abrupt and unsettling for citizens and taxpayers. Due to the change in tax filing and a total one-eighty when it came to the system, taxpayers were bound to get confused which would have caused them to file taxes later than the usual date, which would have in turn caused the state a huge loss in tax revenues.

- Rate disagreements: Another reason as to why several states rejected the proposal of GST was because the tax rates were not being agreed upon. Several states refused to join the Central Government in implementing the GST simply because the rate for the same was either deemed too low or too high. There were states that rejected the proposal for the tax bracket or ceiling proposed by the government.

Tax rates are a crucial part of each and every tax policy and if states disagree upon something as basic as tax rates, the policy faces a lot of backlash. For the GST, to this day, meetings regarding the policy are full of several debates and disagreements, simply because tax rates for the same are on a trial and error basis and some states do not agree with such a process.

Concluding Remarks:

As can be deduced, several states rejected the idea of GST for several reasons, and to this day they reject amendments to the bill. While it can easily be said that GST faces opposition from opposition ruled states, it is truly ignorant to remark that political backings are the only reason GST implemented was rejected by several states.

From what is noted above, it can be seen that some states went against GST because it would adversely affect them when it came to economics, social structure and taxation route.