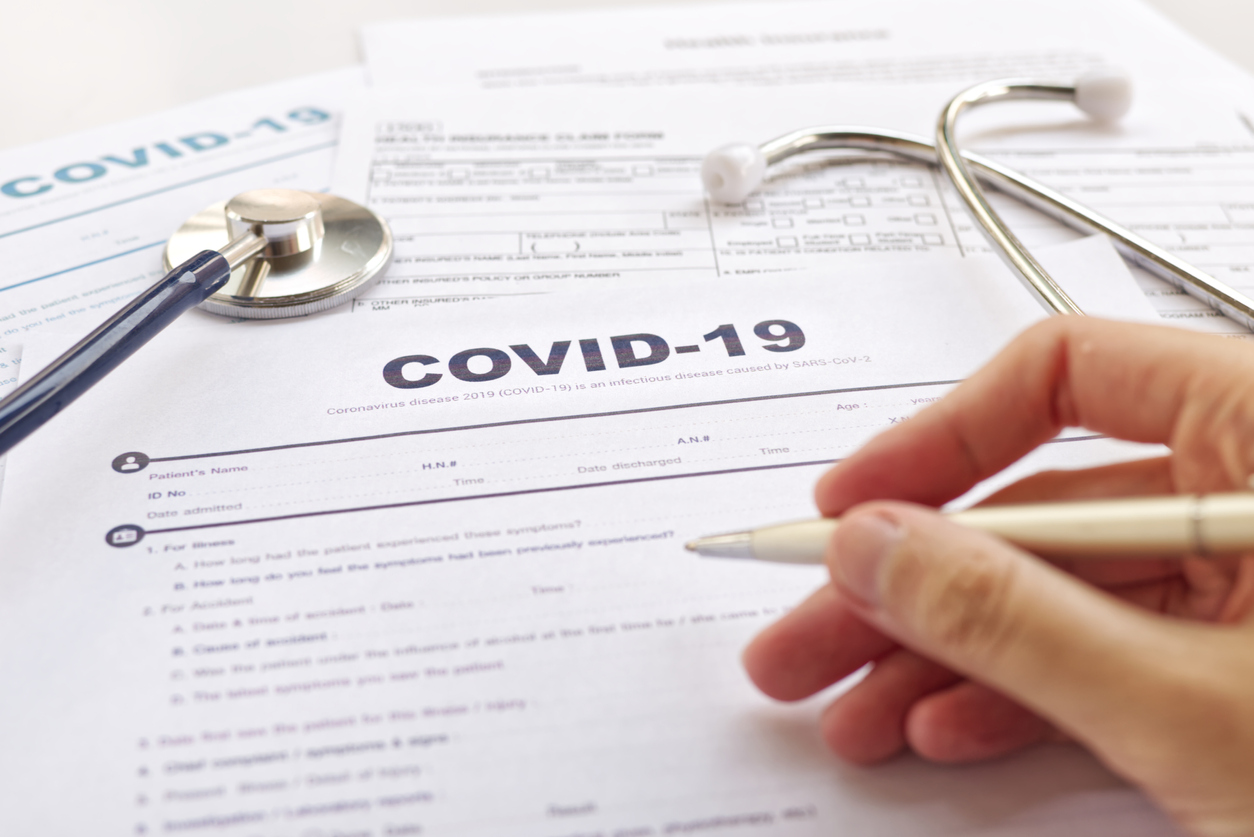

Many months after the initial outbreak in Wuhan, the world is still battling the COVID-19 pandemic. And as researchers continue to explore new drugs and possible vaccines, people need to look for ways to protect themselves from the virus. We all need to stay indoors as much as possible, wear masks if we venture out for essentials, maintain social distancing, and wash our hands regularly. Following these tips should ensure that we stay safe from the coronavirus.

However, just to be extra sure, we should all have the protective coverage of health insurance as well. This will ensure that, in case of COVID-19 related hospitalization, our healthcare expenses will be taken care of and we can get better without worrying about the cost.

Health insurance & COVID-19:

Fortunately, if you have a group health insurance policy, an individual, or a family floater plan, you should be covered for hospitalisation related to COVID-19. Your claim will be payable up to the sum insured of your policy and in accordance with its terms and conditions. Additionally, if you have any sort of hospital cash policy, that should also pay a fixed amount for COVID-19 hospitalization as per your policy terms & conditions.

More good news!

The IRDAI has also given insurance providers in India the go-ahead to provide short-term COVID-19 health insurance plans. This is as per the circular issued on June 23 by the insurance regulator declaring the guidelines for the introduction of short-term health insurance policies providing coverage for COVID-19 disease.

These plans will offer coverage for tenures of 3 to 11 months and will be made available as individual & group products. In another relief or for potential buyers, these short-term COVID-19 health insurance plans will have half the initial waiting period of their traditional counterparts. So, where a normal health insurance plan has a waiting period of 30 days, these short-term COVID-19 plans will have a waiting period of only 15 days. This is perfectly suited for those looking for coverage specifically against COVID-19.

What these plans do not provide.

Since short-term COVID-19 health insurance plans are devised specifically for the coronavirus, some things are excluded from these plans. For instance, you cannot purchase add-ons with these plans. Also, features such as life-long renewability & portability do not apply to these plans.

Who are these plans suited for?

These short-term COVID-19 health insurance plans are suited for those who do not have health insurance or cannot afford a comprehensive policy. It is also well-suited for those who do not wish to spend money on a full-fledged plan and for those who want quicker protection against COVID-19 (shorter waiting period).

Significant progress is being made on the medical front – several vaccines have entered human trials and several treatments are also being tested. A cure and a vaccine should be just around the corner now! However, until then, it makes sense to stay protected by getting a health insurance policy. In this regard, you have one more handy option to choose from in the form of short-term COVID-19 health insurance plans. Hope this has been helpful, good luck and all the best!